Little Known Facts About Nj Cash Buyers.

Little Known Facts About Nj Cash Buyers.

Blog Article

Nj Cash Buyers for Beginners

Table of ContentsWhat Does Nj Cash Buyers Do?The Best Guide To Nj Cash BuyersSome Of Nj Cash BuyersTop Guidelines Of Nj Cash Buyers

By paying cash money, you lose out on this tax obligation benefit. Possessing a home outright can leave you with limited fluid properties readily available for emergency situations, unexpected expenses, or various other financial requirements. Here are some compelling factors to consider getting a home mortgage as opposed to paying money for a house:: By obtaining a home mortgage, you're able to utilize your financial investment and potentially accomplish higher returns.

Instead of linking up a significant quantity of money in your home, you can keep those funds readily available for various other financial investment opportunities - NJ CASH BUYERS.: By not placing all your offered cash money right into a solitary asset, you can preserve an extra diversified financial investment profile. Profile diversity is a key risk monitoring technique. Paying money for a residence uses various benefits, improving the percent of all-cash realty bargains

(http://listingsceo.com/directory/listingdisplay.aspx?lid=76184)The cash money purchase residence process involves locking up a significant portion of fluid assets, potentially restricting financial investment diversification. In contrast, obtaining a home mortgage permits leveraging investments, keeping liquidity, and possibly taking advantage of tax advantages. Whether getting a home or mortgage, it is critical to count on a trustworthy property system such as Houzeo.

The Basic Principles Of Nj Cash Buyers

With thousands of residential or commercial property listings, is one of the largest residential or commercial property noting sites in the US. Yes, you can acquire a house with cash, which is much simpler and helpful than using for home mortgages.

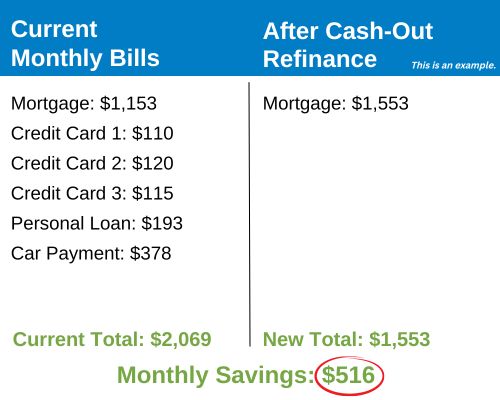

Paying cash for a house locks up a large quantity of your fluid possessions, and restrict your financial flexibility. Additionally, you miss out on tax obligation benefits from mortgage rate of interest reductions and the chance to invest that money in other places for potentially greater returns. Experts show that even if you have the cash money to purchase a home, you must secure a home lending for tax exceptions and much better liquidity.

Since we have actually gone over the demand for cash money offers in today's genuine estate market, allow's explore what they are, that makes them, and their benefits for buyers and sellers. A cash offer in realty simply suggests that the customer does not finance the acquisition with a home mortgage. Usually, the buyer has the total sale amount in their checking account and acquisitions the house with a check or cable transfer.

However, all-cash sales are coming to be increasingly popular, accounting for practically 40% of single-family home and apartment sales in Q2 2024, according to realty data company ATTOM. In 2023's seller's market, many customers had the ability to win proposals and save money on rate of interest many thanks to pay offers. Cash money transactions commonly bring about a quicker closing process, which tempts vendors to approve such bids.

Little Known Questions About Nj Cash Buyers.

Genuine estate investors might locate the purchase of rental homes with cash money to be tempting. This strategy offers its share of benefits and negative aspects, we will examine them right here to allow capitalists to make an enlightened choice concerning which route is ideal for them. Money purchases of rental properties give instant equity without sustaining home loan payments, giving you prompt possession along with monetary versatility for future financial investments and expenses.

Money buyers have an edge when negotiating since sellers prefer to work with those that can close swiftly without requiring contingencies to fund a procurement (cash home buyers in new jersey). This could lead to discount rates or positive terms which increase success for a financial investment choice. Cash buyers do not need to fret about rates of interest fluctuations and the feasible foreclosure threats that go along with leveraged investments, making money acquisitions really feel safer throughout economic slumps

Nj Cash Buyers for Dummies

By paying cash for a rental home acquisition, you are locking away resources that could otherwise have been released somewhere else and generated higher returns. Buying with such huge amounts limitations liquidity and diversification in addition to hinders general profile growth. Cash buyers usually overlook the benefits of using other individuals's funds as mortgages to raise investment returns greatly quicker, which could delay riches accumulation greatly without leveraged financial investments.

Cash money customers might miss out on out on specific deductions that could harm total returns. A financial investment that entails allocating substantial sums of cash in the direction of one building might posture concentration risk if its performance endures or unforeseen problems emerge, offering better stability and durability across your portfolio of properties or asset courses.

There has actually constantly been a competitive advantage to making an all-cash offer, yet when home loan prices are high, there's one more: Borrowing cash is expensive, and spending for the home in full aids you avoid the month-to-month commitment of mortgage settlements and interest. More individuals have taken this route in current years, with the portion of purchasers making use of a home mortgage to purchase a home dropping from 87 percent in 2021 to 80 percent in 2023, according to the National Organization of Realtors' newest Account of Home Customers and Vendors. Obviously, a lot of Americans don't have thousands of countless bucks lying around waiting to be invested.

Even if you can manage to get a home in money, should you? Is it a wise idea? Here are the advantages and disadvantages. Yes, it is feasible and flawlessly lawful to buy a home in full, equally as you would a smaller-ticket thing like, say, a layer. This is described as an all-cash bargain, also if you're not in fact paying in paper cash.

Report this page